In today’s fast-paced digital economy, platforms like SkilzMatrix have emerged as vital bridges connecting skilled professionals with businesses seeking quality services. As with any professional engagement, proper documentation is critical to ensuring smooth operations, legal compliance, and timely payments. One of the key documents required when engaging with SkilzMatrix is the W9 Form — a simple but essential form used in the U.S. tax system. This article explores the role of the W9 form in the context of working with SkilzMatrix, its importance, how to complete it, and best practices for managing your freelance or contract journey.

Understanding SkilzMatrix and Its Purpose

SkilzMatrix is an online platform or company that connects businesses with freelancers, consultants, and independent contractors across a range of industries. Whether you’re a graphic designer, content writer, software developer, or virtual assistant, SkilzMatrix offers opportunities to showcase your talent and secure paid projects. In essence, it acts as a marketplace where businesses can outsource tasks to professionals without the overhead of hiring full-time employees.

As an independent contractor, working through SkilzMatrix grants you the flexibility to choose your projects, negotiate rates, and work remotely. However, this independence also brings certain responsibilities — especially when it comes to taxes and documentation.

What is a W9 Form?

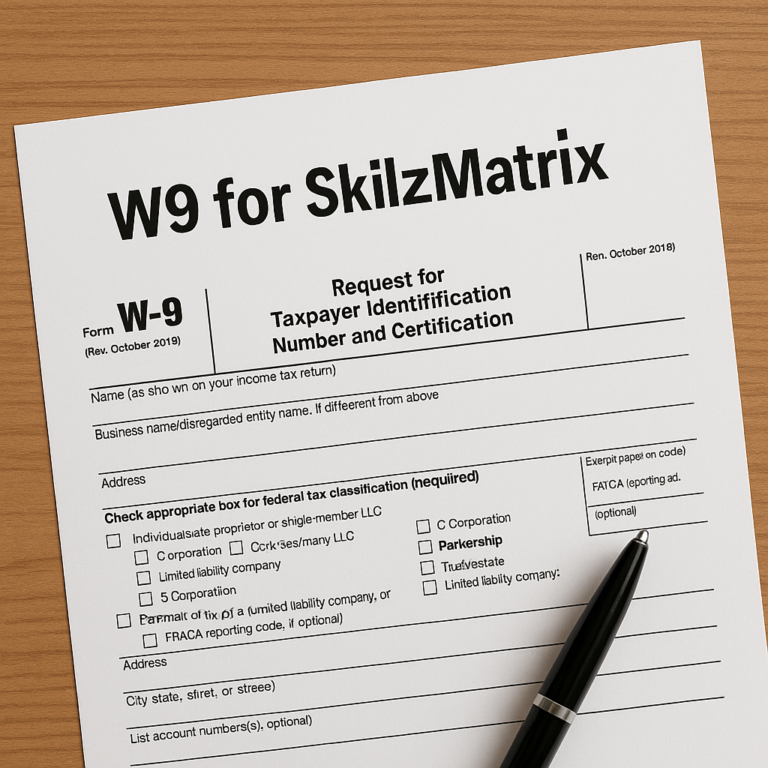

The W9 form is an official document issued by the Internal Revenue Service (IRS) in the United States. Its full name is “Request for Taxpayer Identification Number and Certification.” The primary purpose of the W9 is to provide a business (like SkilzMatrix) with your Taxpayer Identification Number (TIN).

Companies use the information provided in the W9 form to issue Form 1099-NEC at the end of the year, which reports how much they’ve paid you over the course of the year. If you earn $600 or more from SkilzMatrix within a tax year, they are required to send you and the IRS a 1099-NEC form based on the details from your W9.

Why SkilzMatrix Requires Your W9

When you engage in work through SkilzMatrix as an independent contractor, you are not treated as an employee. That means SkilzMatrix does not withhold income taxes, Social Security, or Medicare taxes from your payments. Instead, you are responsible for handling your own tax filings. To comply with IRS regulations, SkilzMatrix needs your W9 on file to:

-

Report your earnings to the IRS correctly.

-

Generate your 1099-NEC form during tax season.

-

Ensure they are paying a verified taxpayer.

-

Protect themselves from liability in case of IRS audits.

Without a completed W9 form, SkilzMatrix may be forced to withhold backup withholding tax (currently 24%) from your earnings. That’s why submitting a correct and timely W9 is in your best interest.

How to Complete Your W9 Form for SkilzMatrix

Filling out the W9 form is a straightforward process. Here’s a step-by-step breakdown:

-

Enter Your Name: Use your full legal name as it appears on your tax returns.

-

Business Name (if any): If you operate under a business name or a DBA (Doing Business As), list it here.

-

Check Federal Tax Classification: Choose whether you’re an individual/sole proprietor, partnership, C corporation, S corporation, trust/estate, or LLC. Most freelancers select “Individual/sole proprietor.”

-

Exemptions: This section is usually left blank unless you’re exempt from backup withholding or FATCA reporting.

-

Address: Enter your current address where you receive tax-related correspondence.

-

Taxpayer Identification Number (TIN): Provide your SSN or EIN.

-

Signature and Date: Sign and date the form to certify that all information is correct.

After completing the form, you typically upload it to your SkilzMatrix profile or send it via secure email or portal provided by the platform.

Security and Privacy Considerations

Here are a few tips to ensure your privacy:

-

Only submit the form through official SkilzMatrix channels.

-

Avoid sending the W9 through unsecured email.

-

Double-check the recipient email or link before uploading.

-

Keep a copy of your submitted W9 in a secure, encrypted folder.

SkilzMatrix, as a reputable platform, should have measures in place to securely store and protect your information. Always confirm their data protection policies if you’re unsure.

What Happens After You Submit Your W9?

Once SkilzMatrix receives and verifies your W9:

-

Your payment processing continues normally.

-

You are now responsible for declaring this income on your tax return.

-

If you did not meet the $600 threshold, you may not receive a 1099-NEC, but you are still legally required to report the income.

This process ensures tax compliance and prevents unnecessary legal complications.

Freelancing Smartly: Tax and Financial Tips

Working independently through SkilzMatrix means you are self-employed. Here are some smart practices to manage your finances effectively:

-

Set aside money for taxes (typically 20–30% of your earnings).

-

Use accounting software like QuickBooks or Wave to track income and expenses.

-

Deduct business-related expenses, such as internet bills, software licenses, and home office costs.

-

Consult a tax professional annually to maximize deductions and stay compliant.

-

Make estimated tax payments quarterly if your income is consistent.

Conclusion

Engaging in freelance or contract work through SkilzMatrix can be a rewarding experience that offers flexibility, independence, and growth. However, staying compliant with tax laws is a critical part of this journey. Submitting your W9 form is a small but essential step that allows SkilzMatrix to process your payments correctly and issue necessary tax documents at year’s end.

Understanding the W9 process, ensuring accurate submission, and keeping your financial records in order will not only protect you legally but also help you build a solid and professional freelancing career. With proper documentation and responsible financial habits, your journey through SkilzMatrix can be smooth, secure, and successful.